Broadcom doesn’t make splashy headlines like Nvidia or AMD. It doesn’t host flashy keynotes or talk about trillion-dollar TAMs. But in the background of every major AI deal this year, from OpenAI to Oracle and the hyperscalers, Broadcom has been the one quietly wiring the world’s AI infrastructure together.

After going through Broadcom’s Q3 numbers, the $10 billion XPU order announcement, and the company’s expanding hyperscaler partnerships, Broadcom is a Strong Buy in my books. What’s happening here isn’t just an earnings beat, it’s a structural shift in how AI computing will be built, and Broadcom is at the center of it.

Fundamentals: An AI Growth Engine Hiding in Plain Sight

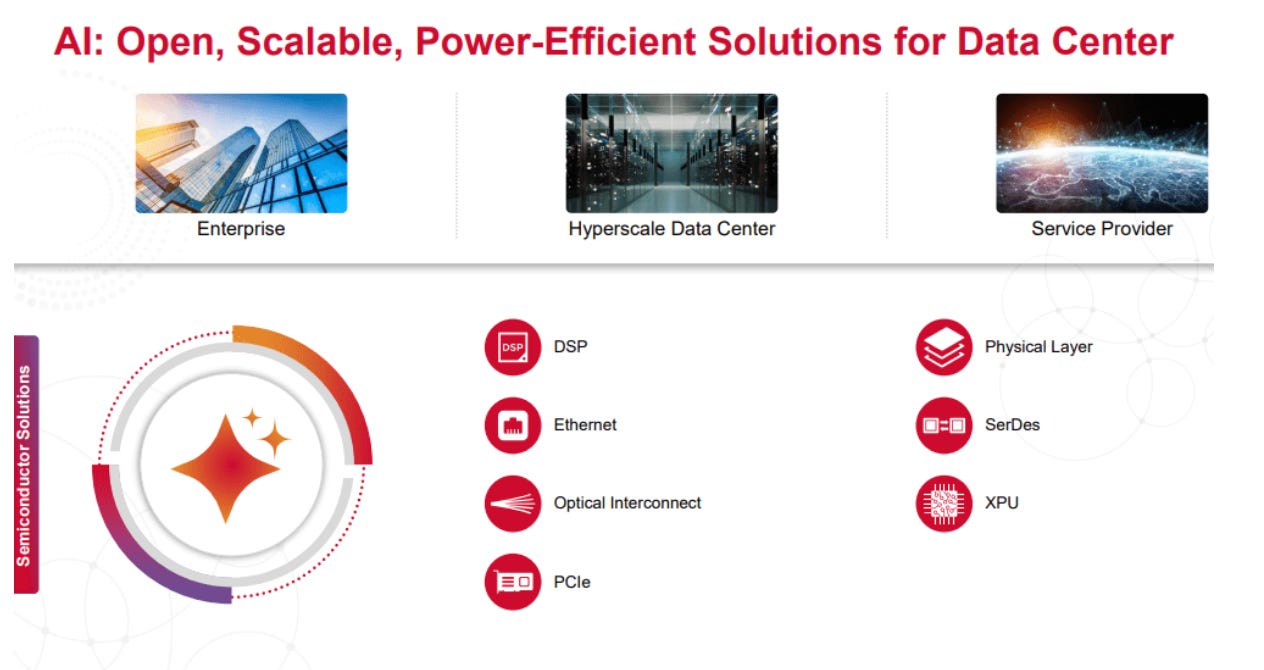

Broadcom has built its business around a few key pillars: custom semiconductors (ASICs and XPUs), networking solutions, and enterprise software through VMware. It’s an unusual combination, but one that provides both growth and stability, cyclical upside from chips, recurring cash flow from software, and unmatched exposure to AI infrastructure.

In Q3 FY25, Broadcom reported AI semiconductor revenue of $5.2 billion, up 63% year-over-year, marking its tenth straight quarter of growth. The company expects another 66% jump in Q4, bringing AI semiconductor revenue to around $6.2 billion. These aren’t short-term tailwinds; they represent a multi-year shift in demand for custom accelerators that can handle large-scale model training.

Broadcom’s backlog hit a record $110 billion, providing exceptional visibility into future revenue streams. The backlog alone tells me that the next two fiscal years are essentially “locked in.” Management’s guidance calls for EBITDA margins of 65%+, with $10.7 billion in adjusted EBITDA and $7 billion in free cash flow in the latest quarter.

To put that in perspective: Broadcom is generating more quarterly FCF than most semiconductor firms produce in a year, while maintaining sector-leading margins.

The $10 Billion XPU Deal: A New Era for Custom AI Silicon

The real inflection point came with Broadcom’s $10 billion XPU order, which added a fourth major customer to its AI chip roster. The order will be fulfilled through FY26 and is already reflected in Broadcom’s backlog.

What makes this deal so important isn’t just the number — it’s who the customer is. Multiple reports have identified OpenAI as the client, marking the company’s first large-scale engagement with a non-GPU vendor.

This is significant for several reasons:

Strategic diversification: OpenAI isn’t abandoning Nvidia, but it’s hedging dependence by developing its own internal silicon, similar to what Google did with TPU and Amazon with Trainium. Broadcom’s ability to co-engineer those chips gives it a front-row seat to the next generation of AI hardware.